28th September 2021

- 0 commentsAIM-listed Hardide plc has secured a £250,000 funding package from the Midlands Engine Investment Fund (MEIF) East & South East Midlands Debt Finance fund, managed by Maven Capital Partners and backed by the Coronavirus Business Interruption Loan Scheme (CBILS).

28th September 2021

- 0 commentsMaidenhead based company, Made for Drink, has secured a £300k loan from the Thames Valley Berkshire (TVB) Funding Escalator to develop its product range and enable the creation of 13 new jobs.

22nd September 2021

- 0 commentsBritish Business Bank is managing £89bn of finance support to 1.77m businesses, up from £8bn in 2020, with an above target adjusted return of 14.6%

22nd September 2021

- 0 commentsFintech business lender MarketFinance has announced a £280m debt and equity fundraise and its accreditation under the Recovery Loan Scheme (RLS). This comes after MarketFinance became one of the first fintechs to be accredited under the Coronavirus Business Interruption Loan Scheme (CBILS), having lent £250m to companies across the UK.

20th September 2021

- 0 commentsEssentially Yours, a Kidderminster-based skin care supplier, has secured £200,000 from the Midlands Engine Investment Fund (MEIF) West Midlands Debt Finance, managed by Maven Capital Partners, backed by the Coronavirus Business Interruption Scheme Loan (CBILS).

17th September 2021

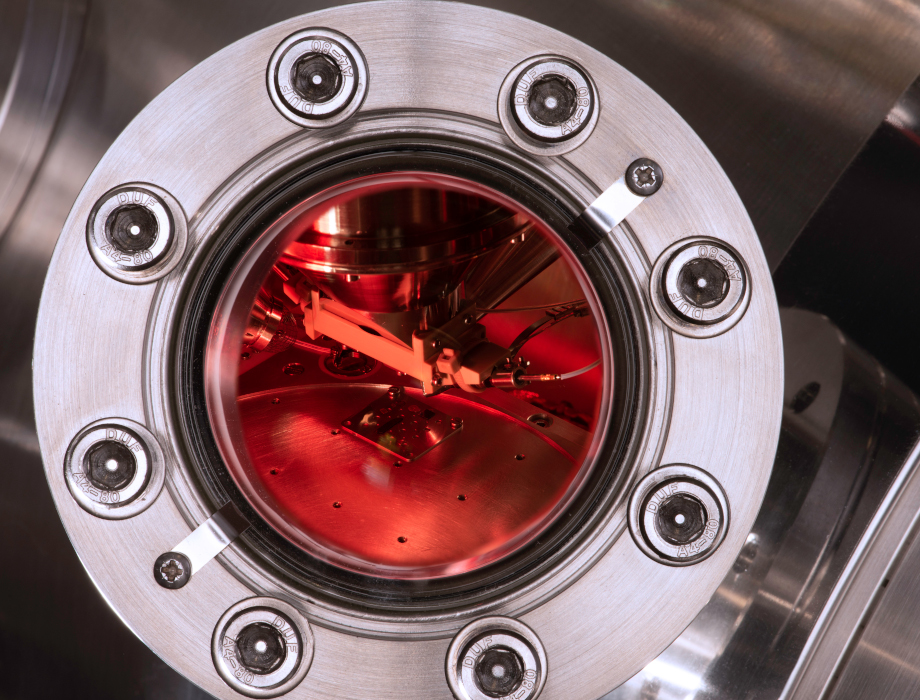

- 0 commentsIonoptika Ltd and the University of Surrey have been awarded project grants worth a total of £425,000.00 from Innovate UK,

13th September 2021

- 0 commentsMaven Capital Partners, one of the UK’s most active private equity houses, has led a £4.4 million investment in Candle Shack, a rapidly growing eCommerce business supplying candle making components as well as providing contract candle manufacture for high profile, luxury brands. The transaction includes £3 million of funding from Maven’s high net worth investment syndicate, Maven Investor Partners, as well as a £1.4 million debt facility from HSBC UK.

10th September 2021

- 0 commentsSouthwark based technology platform business, Landmrk, has received a £225,000 loan from the Greater London Investment Fund via The FSE Group. The loan is backed by the Coronavirus Business Interruption Loan Scheme (CBILS).

8th September 2021

- 0 commentsMaven Capital Partners, one of the UK’s most active SME finance providers, has provided a substantial debt funding package to Differentology Ltd via the North East Development Capital Fund, supported by the European Regional Development Fund. The funding will enable the company to deliver on its ambitious expansion plans and embark on a management buyout to exploit opportunities in new markets.

1st September 2021

- 0 commentsForesight Group, an award-winning listed alternative investment manager, has provided a senior secured debt facility of up to £25 million to specialist secured SME lender, Fresh Thinking Capital.

24th August 2021

- 0 commentsHoward Town Brewery has secured a £150,000 funding package from the Midlands Engine Investment Fund (MEIF) East & South East Midlands Debt Finance fund, managed by Maven Capital Partners and backed by the Coronavirus Business Interruption Loan Scheme (CBILS).

20th August 2021

- 0 commentsThe British Business Bank has announced a further £62.4m of financing to Shire Leasing under its ENABLE Funding programme, which aims to improve the supply of finance solutions to smaller UK businesses for business–critical assets. The transaction follows on from a first round of funding of £37.4m in 2017 - bringing the overall amount of money under the ENABLE Funding programme awarded to £99.8m.

Back to Homepage