20th June 2025

- 0 commentsAnzen, a pioneering climate tech startup, has secured £1.1 million in its pre-seed funding round. The investment was led by Green Angel Ventures and Desai Ventures, with significant contributions from Sustainable Ventures, Colbridge Ventures, One Planet Capital, and experienced energy industry investors.

13th June 2025

- 0 commentsVoltavate, an early-stage battery tech company, has raised A$850,000 in an oversubscribed pre-seed round led by Artesian, with support from Investible, Electrifi Ventures, and leading industry angels including John Wood, Christiaan Jordaan, Steven Vassiloudis, and Reza Behnam. Reza also serves as Voltavate's Chairman.

30th May 2025

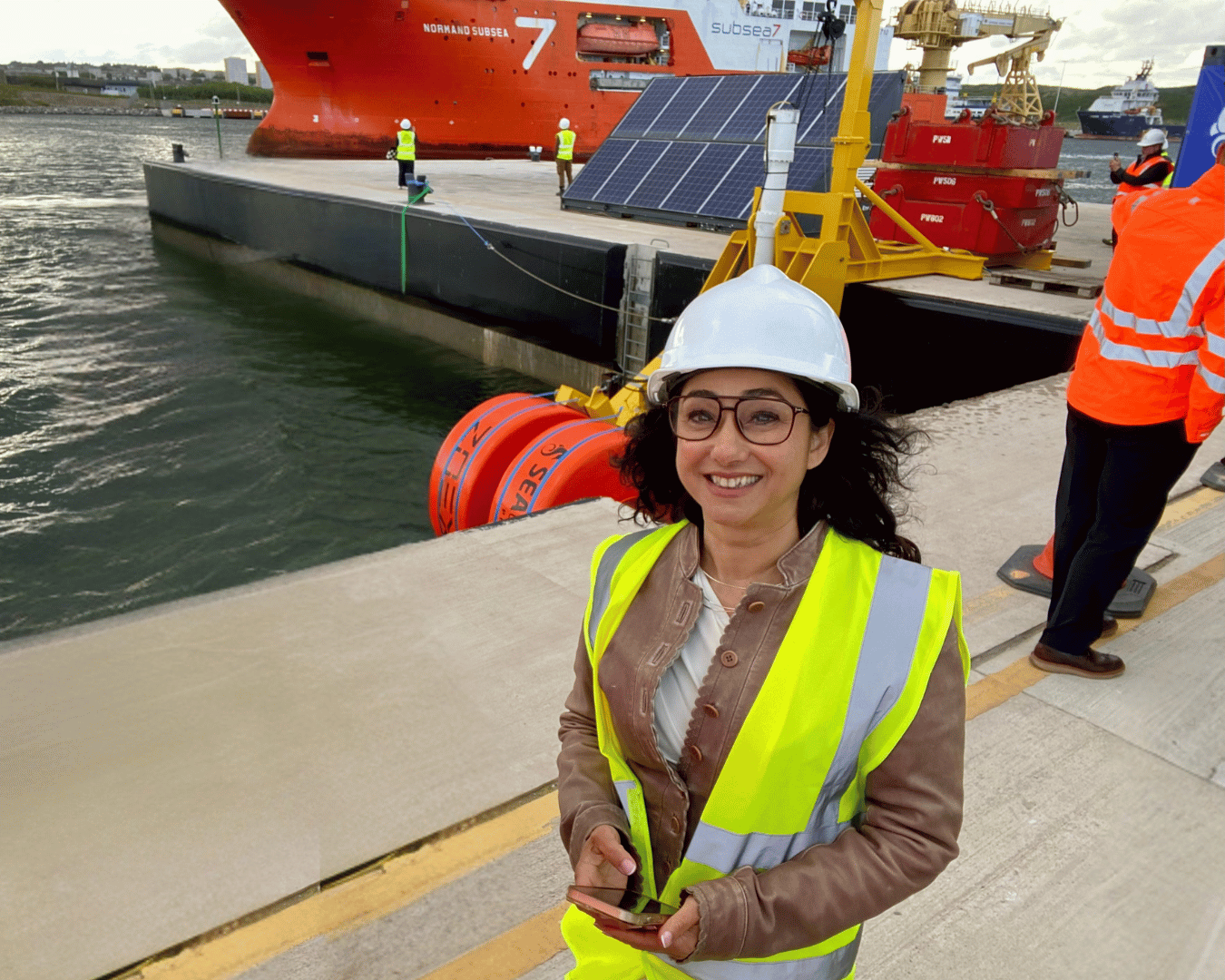

- 0 commentsAberdeen-based ZOEX Ltd, the UK’s only female-founded wave energy company, is riding a wave of investment success after securing £531,000 funding including investment from Equity Gap, one of Scotland’s leading angel investment syndicates, The University of Strathclyde and Scottish Enterprise.

23rd May 2025

- 0 commentsRivan, a company enabling energy security through synthetic fuels, has raised £10 million in funding led by Plural, with participation from 20VC, NFDG (Nat Friedman and Daniel Gross), and prominent angel investors Patrick and John Collison (Stripe). The capital will be used for R&D on Rivan's electrolyser, direct-air-capture (DAC) and Sabatier reactor modules, as well as scaling its pilot plant up to 1MW.

23rd May 2025

- 0 commentsGreen Angel Ventures has backed Sention Technologies in its latest seed round, bringing the company's total funding to £3.7 million as it commercialises its battery diagnostics technologies.

16th May 2025

- 0 commentsGreen Angel Ventures has made a follow-on investment in PES Technologies, which has just closed a £1.3m pre-Series A funding round. The round was led by TSP Ventures, with participation from Green Angel Ventures, Kero Development Partners, and Moorhampton Investments Limited.

16th May 2025

- 0 commentsCarbon Cell, a materials innovation company, has raised £1.2m in a pre-seed round to scale its novel, plastic-free foam made from biochar and natural polymers. This round was led by Green Angel Ventures and Counteract, with participation from HERmesa, RCA Design and Innovation S/EIS Fund, and One Planet Capital.

At the core of Carbon Cell's solution is biochar, a carbon-rich material made from agricultural waste that would otherwise be burned or left to decompose. Combined with natural polymers, this creates a high-performance, fully compostable foam that not only avoids plastics and petrochemicals but also boasts a negative carbon footprint because of the carbon captured within the biochar used to make the material.

9th May 2025

- 0 commentsOxford Innovation Finance's EIS Growth Fund and OION Angel Network have invested in Gardin, the first real-time, remote and autonomous crop phenotyping SaaS platform, alongside LDV Capital, MMC, Navus Ventures and other investors.

2nd May 2025

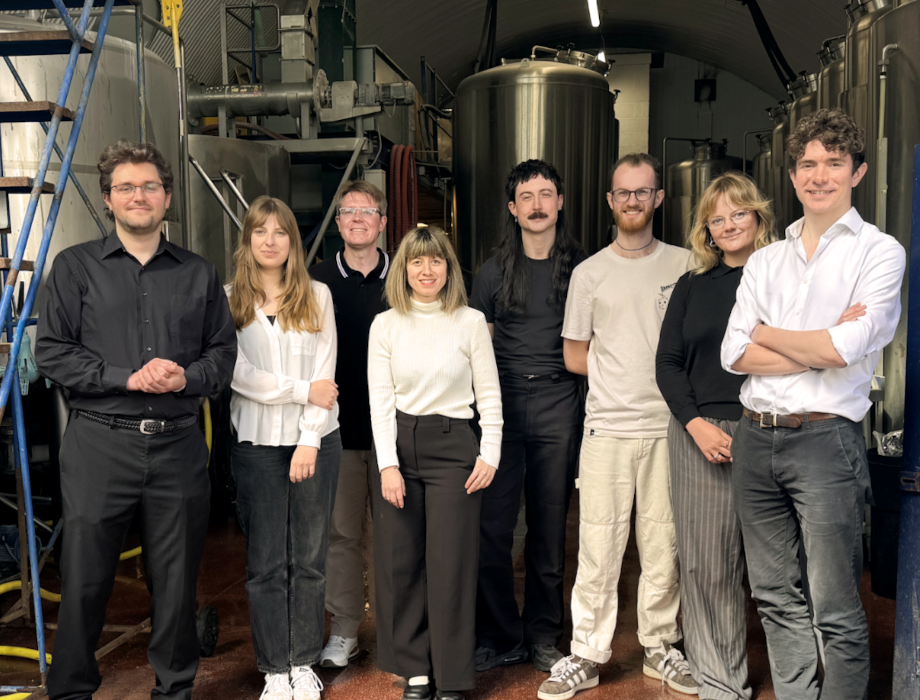

- 0 commentsGreen Angel Ventures has invested in Arda Biomaterials, a chemistry technology company creating high-performance materials from industrial food waste.

Arda has raised £4.05M in its latest round, led by Oyster Bay Venture Capital, alongside Green Angel Ventures, Clean Growth Fund, and Kadmos Capital. The new funding will enable Arda to make advancements in the R&D of its first product, New GrainTM, a plant-based, plastic-free, leather-like material derived from spent grain, the byproduct of beer and whisky production.

25th April 2025

- 0 commentsFuel Ventures has led an investment round for pioneering climate-success company, 51toCarbonZero, the first platform to ensure effective corporate transition to net zero while boosting clients' business performance. The £3 million funding round, which includes contributions from angel investors, follows a previous investment by Fuel Ventures and reflects the significant growth 51toCarbonZero has achieved since then.

17th April 2025

- 0 commentsA UK company whose energy management app rewards consumers for switching off appliances at peak times has raised a further £700,000 from the North East Venture Fund, supported by the European Regional Development Fund and managed by Mercia Ventures, and private investors.

17th April 2025

- 0 commentsFlock Mobility, the UK cleantech startup transforming how organisations run shared transport, has secured £1 million in funding to fuel its next phase of growth. The round includes backing from Skyscanner founder Gareth Williams and a Boston-based family office, signalling strong investor confidence in Flock's mission and momentum.

Back to Homepage