4th October 2024

- 0 commentsNETHERLANDS: Plumery, a digital banking experience platform for true customer-centric banking, has announced it has secured $3.3M in additional funding from early-stage investor DN Capital and funds managed by leading global VC firm QED Investors, alongside others, including business angels. The latest round brings Plumery’s total funding to date to USD 7.8M and is in preparation for a larger Series A round in 2025.

27th September 2024

- 0 commentsChallenger Credit Reference Agency, Infact has raised a £4 million seed funding round after securing FCA authorisation to establish the first real-time credit bureau for the digital financial services market.

The funding was led by AlbionVC, with participation from 13books Capital, Outward VC, Form Ventures, and Portfolio Ventures. Infact is also backed by leading angel investors in the credit referencing, lending, and fintech space. This investment will be used to accelerate building the richer bureau database and to extend the product suite to help challenger lenders and banks reset the scales when it comes to credit.

16th August 2024

- 0 commentsQardy, the first digital lending marketplace in Egypt and the MENA region for financial institutions to fund MSMEs, has successfully secured a $ 7-figure pre-seed round of investment, with participation from White Field Ventures and Vastly Valuable Ventures among other Angel Investors.

26th July 2024

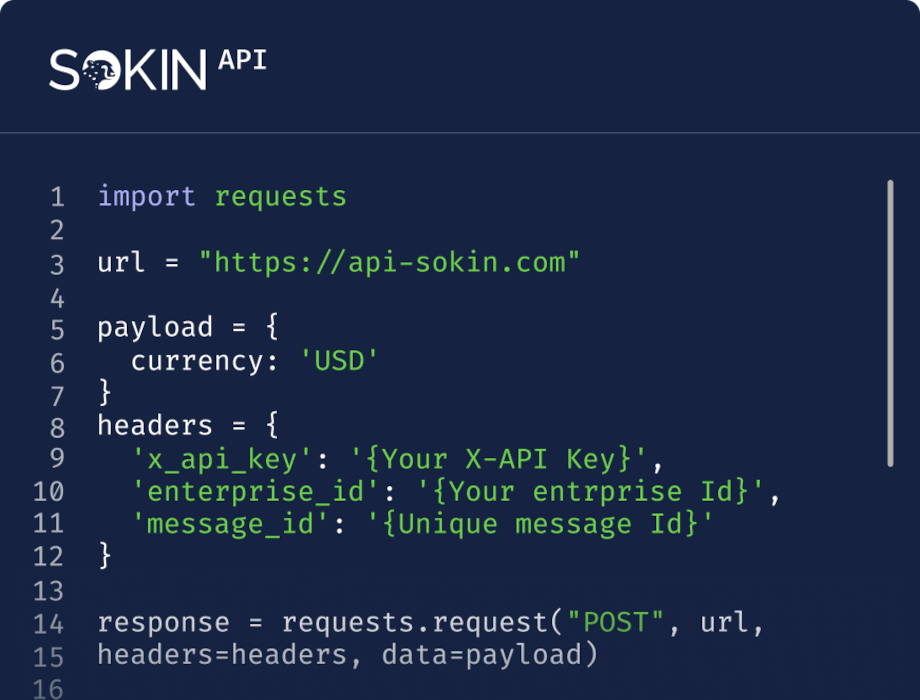

- 0 commentsInvestment funds managed by Morgan Stanley Expansion Capital have acquired a stake in UK headquartered payments business Sokin, marking an exciting new chapter for the fast-expanding fintech firm. The acquisition will provide significant capital and accelerate its product growth plans and further global expansion.

31st May 2024

- 0 commentsDENMARK: Copenhagen-based fintech startup, ZTLment, has made waves as the first in Europe to pioneer compliant wallet infrastructure on decentralised rails for ordering- and booking platforms. Having raised €2.4 million in total pre-seed funding from investors PreSeed Ventures, Upfin, Giant Ventures, and strong business angels, ZTLment aims to eliminate the need for outdated banking infrastructures once and for all and make it easy to make programmable and peer-to-peer payments.

10th May 2024

- 0 commentsFirenze, a Manchester-based fintech has raised £750K at a valuation of £3.75 million in a pre-seed angel round. The investment will be used to accelerate its mission to democratise access to Lombard lending. It will allow Firenze to continue its team growth and start onboarding the first wealth managers and platforms.

26th April 2024

- 0 commentsFundpath, the critical data and business intelligence service for the wealth and asset management industry, has copmpleted a £2 million funding round with its venture capital partner, Fuel Ventures. This second round of funding follows a £4m investment made in March 2023.

19th April 2024

- 0 commentsInvestment and pension provider Prosper is establishing a back office at Capital Quarter in Cardiff following an investment of £520,000 from the Development Bank of Wales and a syndicate of 11 business angels.

22nd March 2024

- 0 commentsWinefi, a UK-based start-up building a nextgeneration wine investment marketplace which successfully raised £400,000 from SFC Capital and other angel investors at the end of 2023, has announced a partnership with Wealt, a wealth management platform that allows investors to manage all of their bankable and non-bankable assets in one place, to offer investors easy and cost-effective access to fine wine as an asset class.

22nd March 2024

- 0 commentsArrow Risk Management, a specialist managing general agency (MGA) underwriting platform that provides brokers and carriers with real-time data across the insurance lifecycle, has raised £2 million in funding, led by ACF Investors and a range of EIS investors. This investment will be used to fuel expansion plans and further develop its underwriting platform.

15th December 2023

- 0 commentsHope Macy, the FCA authorised UK Fintech, has obtained £1.5m in seed investment from the Development Bank of Wales, and a supportive angel network, to extend the development and roll-out of its regulated Open Banking and AI platform across the UK to counter the growing problem of financial vulnerability.

15th December 2023

- 0 commentsWealthtech platform Prosper has closed its first crowdfunding campaign, raising over £1 million and topping up the £3.2m already raised from investors including Monzo’s co-founder Tom Blomfield, Capital One’s co-founder Matt Cooper, and many other high-profile fintech angels.

Prosper was founded by fintech entrepreneurs Ricky Knox, Nick Perrett, and Phil Bungey, who previously built businesses such as Nutmeg and Tandem Bank.

Back to Homepage