24th January 2025

- 0 commentsTalentMapper, a London-based company whose platform helps identify and develop the skills within an organisation, has raised £2m from Mercia Ventures and Haatch.

Despite being launched just 18 months ago, TalentMapper has already attracted major clients including Dunelm, Danone and Mountain Warehouse and achieved annual recurring revenue of over £700,000. The funding will enable the company to enhance the platform, expand its team and continue its rapid growth.

24th January 2025

- 0 commentsNorthstar Ventures has led a £750,000 investment round into OnHand, the innovative social impact platform enabling businesses to become more responsible by empowering employees to drive meaningful change through corporate social responsibility initiatives. £325,000 has been invested by the North East Innovation Fund supported by the European Regional Development Fund and £175,000 from Northstar's EIS Growth Fund, alongside investment by 24 Haymarket. Total investment in OnHand to date now tops over £5m.

17th January 2025

- 0 commentsThe Scottish women-led angel investment group, Mint Ventures, has added to its portfolio by investing in Hampshire-based legal case management platform Transparently, which is led by family law specialist, Becki Sant-Cassia.

Transparently has developed a platform that enables lawyers to engage with clients through alternative service delivery models and for clients to work with legal professionals as and when their resources allow.

6th September 2024

- 0 commentsSustainability startup Signol, which uses behavioural science to reduce emissions in shipping and aviation, has raised £2.5m from leading industry-focused investors.

23rd August 2024

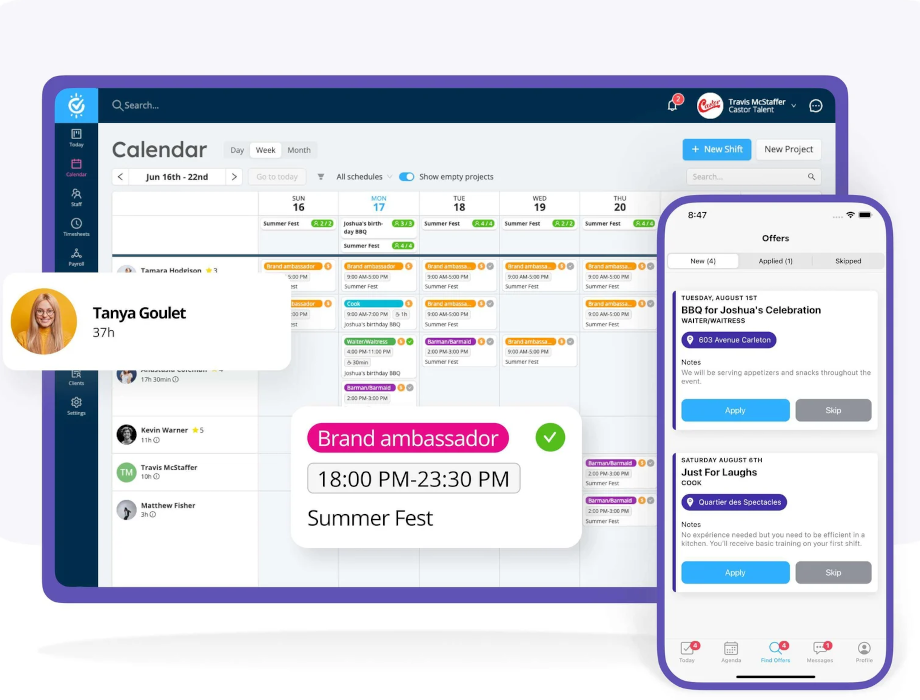

- 0 commentsMONTRÉAL: Workstaff, a Montreal-based provider of workforce management tools for businesses that manage temporary and flexible staff, has closed $1.6M CAD in seed financing.

The round closed in the second quarter of 2024 and included investments from Impulsion PME, a Gouvernement du Québec program managed by Investissement Québec, and Anges Québec. This new investment will enable Workstaff to continue expanding into global markets and enhance its already robust product offering that helps companies easily find, schedule, and manage temporary and flexible staff.

16th August 2024

- 0 commentsBirmingham-based supply chain risk management company Bendi Software Limited, has secured a £815,000 seed funding round to support the development of its AI-powered data intelligence software, Prism. Led by a £230,000 investment from the West Midlands Co-Investment Fund (WMCO), the funding will enable Bendi to expand its team, enhance its product offering, and explore new market opportunities. The fund is managed by Midven, part of Future Planet Capital.

19th July 2024

- 0 commentsLegalFly, a pioneering legal AI platform, has raised over €15 million in Series A funding led by Notion Capital, with participation from redalpine and Fortino Capital. Founded one year ago, LegalFly has swiftly made its mark on the legal tech industry. This investment comes just eight months after the company’s €2 million Seed round led by redalpine, which saw early participation from industry leaders including Mehdi Ghissassi, Director of Product at Google Deepmind.

12th April 2024

- 0 commentsDUBAI: Gingo Partners, an Investor Outreach Service and Startup Community, has completed its fundraising campaign, securing $350k in capital from a group of business angels.

12th April 2024

- 0 commentsVeremark, a global background screening company, has secured $3 million in a Pre-Series B round led by Samaipata and Stage 2 Capital and including participation from ACF Investors and Vulpes Investment. The investment will be used to support Veremark’s continued client acquisition and further develop its screening technology.

The need for more compliant hiring has become a global requirement, with background screening alone equating to a $8bn global market in desperate need of innovation. Veremark provides a global background screening service that helps companies run checks on prospective employees, business partners, limited partners and founders — therefore reducing the risk of hiring or working with underqualified or legally unsuitable people.

9th February 2024

- 0 commentsManchester-based The Insights Family, a global leader in kids, parents, and family market intelligence, has announced a significant £5.6 million investment round led by BGF – one of the largest and most experienced growth capital investors in the UK and Ireland.

BGF has invested £5 million in the business, with additional participation from DSW Ventures, – the venture capital arm of Dow Schofield Watts, marking a pivotal step for The Insights Family.

24th November 2023

- 0 commentsThe Development Bank of Wales and a syndicate of nine business angels are backing Academii, a Cardiff start-up with an equity investment of £370,000 that will help transform workplace training.

20th October 2023

- 0 commentsPanoramic Growth Equity and Maven Capital Partners, through its professional client investment platform, Maven Investor Partners, have backed the management buyout of Glasgow-based distribution and logistics specialist Bullet Express.

The transaction includes a multi-million pound investment from Panoramic and Maven, alongside the existing Bullet shareholders, David McCutcheon, Gary Smith and John McKail. The transaction was introduced by Emerald Capital Partners, who also invested in the deal via Maven Investor Partners.

Back to Homepage