26th July 2024

- 0 commentsWealthbrite, an award-winning company whose AI-powered accelerator programmes enable businesses to build financially savvy teams has closed a pre-seed round of £200,000 from angel investors to expand into new markets.

26th July 2024

- 0 commentsPioneering audio technology company Submix has closed a $1 million funding round. This investment will drive Submix's mission to enhance remote collaboration for musicians, producers, and audio professionals, fundamentally reshaping their workflow and access to global opportunities.

19th July 2024

- 0 commentsGlobal pharmaceutical company Eli Lilly and Company has acquired Aparito, the Wrexham-based med-tech business set up by Dr Elin Haf Davies and part-funded by the Development Bank of Wales who now exit with an initial return of 2.9x on their £1.2 million equity investment.

19th July 2024

- 0 commentsCubbit, the first geo-distributed cloud storage enabler, has closed its $12.5M funding round. With this new funding the company will enable European Service Providers and Companies to take back full independence and control over their data, infrastructures, and costs.

19th July 2024

- 0 commentsYond, a revolutionary travel planning app that will transform how travellers explore the world, has secured £150,000 in a pre-Seed round led by early-stage venture capital firm Jenson Funding Partners, alongside a number of angel investors. Founded in 2023 by Mark Merrywest and Emily Vinsen, the funding will be used for product development and go-to-market activities to test and validate the new social commerce concept and ensure product-market fit.

12th July 2024

- 0 commentsNALA, a leading UK fintech company has raised $40 million in Series A funding to support its global expansion and enhance the reliability of payments to Africa by developing its payment rails.

5th July 2024

- 0 commentsSupercede, the leading reinsurance technology platform, has completed a $15 million Series A funding round from new and existing investors.

5th July 2024

- 0 commentsBrainspark games has secured £1.4m in angel investment and its 7th Innovate UK ‘Investor Partnership’ grant. £700,000 has been secured, with participation from a range of ‘Super Angels’ consisting of seasoned investors, games and education industry veterans, exited founders and institutional investors.

5th July 2024

- 0 comments28th June 2024

- 0 commentsOSS Ventures, a leading industrial start-up studio in France, has raised €8.5 million, led by Tikehau Capital, France 2030's French Tech Accélération 2 fund (Bpifrance), Etablissements Peugeot Frères, and business angels including Max Pog.

28th June 2024

- 0 commentsSussex-based angel investment group South East Angels has invested in Skyverse, a software startup helping increase safety and reduce costs in air traffic control operations.

Skyverse helps all airports modernise away from traditional processes to a cloud workflow solution that provides more data, transparency, and insight to a control tower. This solution allows regional and general aviation airports to access the same standard of tools typically delivered to the major international airports.

Skyverse’s SaaS tools replace Air Traffic Services’ paper-based processes and a significant volume of repetitious radio and telephone communications. The tools share clearer, faster and richer information between Air Traffic Services and their network of users. This cuts Controller and Assistant workload while improving safety and situational awareness.

21st June 2024

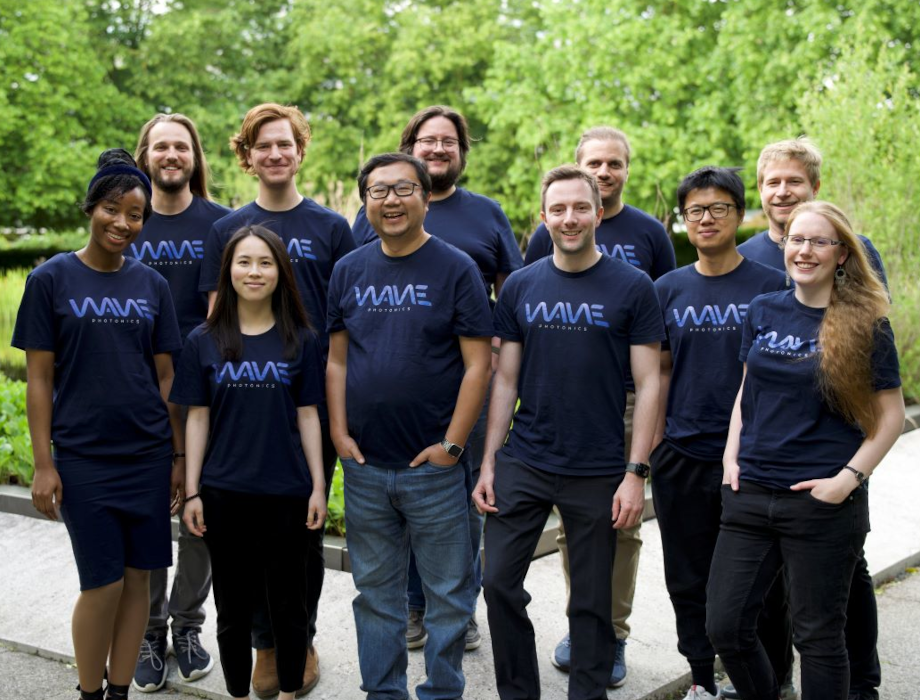

- 0 commentsWave Photonics, a Cambridge-based deep tech start-up, has received £4.5M to develop onchip photonics designs for quantum technologies, sensors, and datacentre applications.

The UK Innovation & Science Seed Fund and Cambridge Enterprise Ventures led the round, with participation from the Redstone and QAI Ventures’ Quantum Fund, Kyra Ventures, and Deep Tech Labs. Several angel investors from the UK, EU and US participated in the round, contributing a total in excess of £400k.

Back to Homepage