16th March 2018

- 0 commentsHoncho relocates to County Durham following investment and creates three jobs to complete software development and product launch.

15th March 2018

- 0 commentsAirsorted, the world’s largest hosting management service, has announced the successful

12th March 2018

- 0 commentsTechnology business Intelligence Fusion has broken through its £400,000 target and has gone on to raise over £486,000 to further develop its online global intelligence and risk management system.

This represents an early success for the new partnership between Growth Capital Ventures (GCV) and Crowdcube, an extension of GCV’s groundbreaking investment model which allows retail investors from the general public to invest alongside experienced and sophisticated investors and financial institutions.

The success of IF’s fund raising coincides with the Chancellor’s Budget proposals to stimulate investment in high growth businesses by attracting £20bn of new investment.

12th March 2018

- 0 commentsDon' worry if you you missed SyndicateRoom's Future of Fintech event on 8th March. You can see Nick Ogden's talk here.

12th March 2018

- 0 comments

OurCrowd, a global leader in equity crowdfunding, today announced the opening of a new office located in Mayfair, London, the 10th dedicated location worldwide. The new office will be headed by Lina White, formerly of Goldman Sachs, who will manage OurCrowd’s activities, among the growing community of British investors interested in funding early stage high-growth tech companies.

9th March 2018

- 0 commentsProperty Investment site Brickowner experiences rapid growth hitting £1 million invested by the public through the crowdfunding platform.

8th March 2018

- 0 commentsDoctor-on-demand app Qured has closed a joint angel and crowd raise of £1.13m through SeedLegals and Seedrs, at a post-money valuation of £5.16m.

8th March 2018

- 0 commentsCrowdcube is 7 years old! It was launched from a small office in the middle of Exeter. Today, it has grown the team across the UK and Spain, been named the No. 1 equity crowdfunding platform for investment, helped over 600 businesses raise growth capital and have a user base of more than 500,000.

7th March 2018

- 0 commentsEvery quarter around 50,000 new businesses startup in London (Source: https://realbusiness.co.uk/business-growth/2017/05/05/uk-top-locations-for-startup-growth-in-2017/) and many of these will turn to crowdfunding to help them launch and/or grow.

27th February 2018

- 0 commentsOurCrowd, a leading global equity crowdfunding platform, has made Fast Company's Most Innovative Companies list for 2018. The top ten companies in Israel include OurCrowd, Insightec, which treats tremors with guided ultrasound; Zebra Medical Vision, which provides lifesaving AI scans at $1 apiece; and Airobotics, a global leader in fully automated industrial drones.

21st February 2018

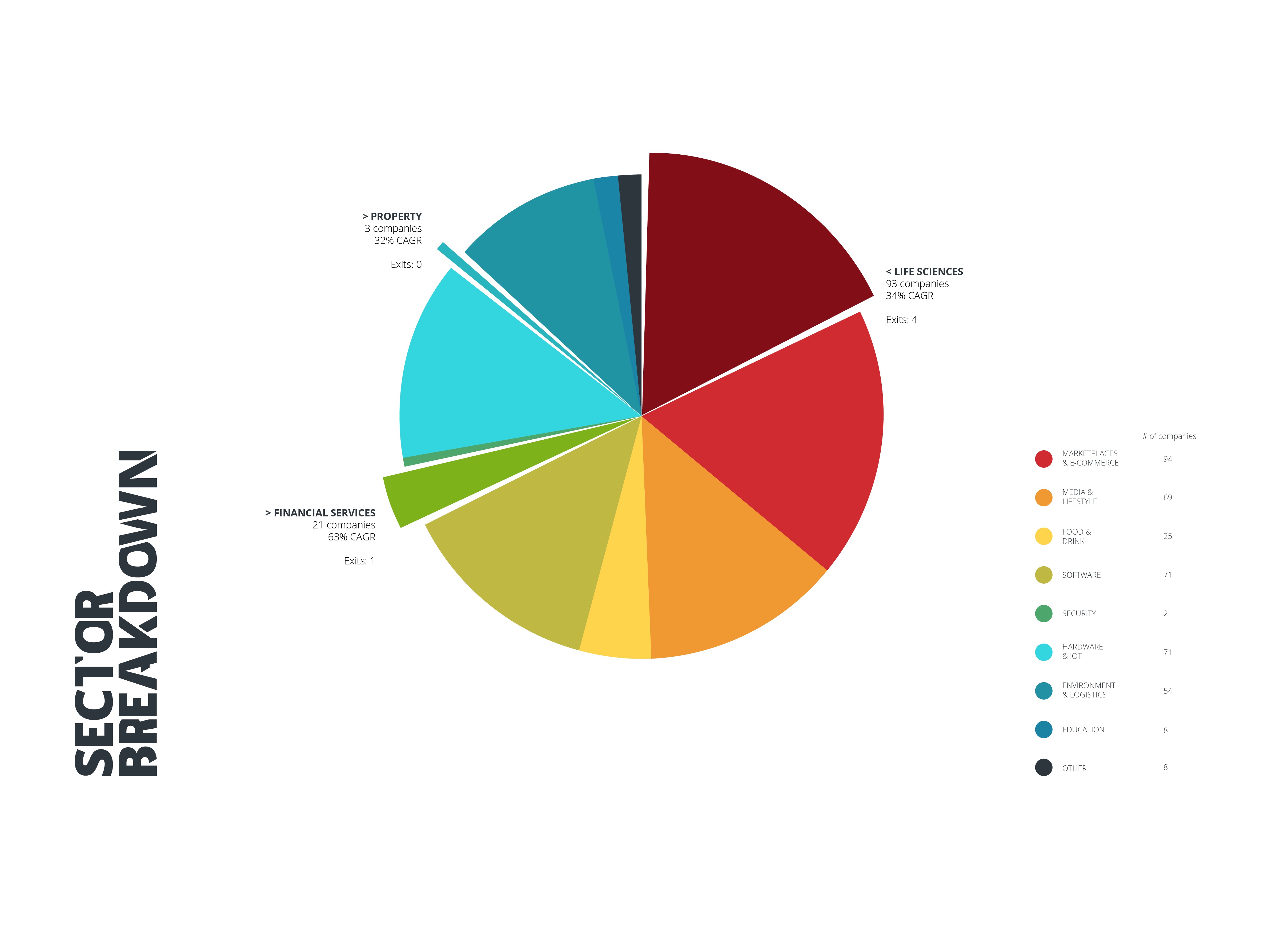

- 0 commentsSyndicateRoom research has revealed that investors in early-stage equities have enjoyed a seventh consecutive year of 30% growth.

14th February 2018

- 0 commentsSeedrs has closed the first trading cycle that has been open to all investors on it’s pioneering Secondary Market. The London-based early stage equity investment platform launched its secondary market in June 2017 and last week announced the next advancement which allows all investors, whether previous shareholders or not, to buy shares on the market.

Back to Homepage