29th October 2018

- 0 commentsThe British Business Bank, the UK government-owned economic development bank, has announced a second £51m tranche of funding for Henry Howard Finance under the Bank’s ENABLE Funding programme. The transaction is the latest made under the programme, which aims to increase the supply of finance to smaller businesses in the UK looking to acquire business critical assets to boost their growth.

24th October 2018

- 0 commentsUK dividends rose 4.1% to £32.3bn in Q3, breaking a third-quarter record, according to the latest UK Dividend Monitor from Link Asset Services. Underlying payouts, which exclude special dividends, reached £31.6bn, a rise of 6.9% year-on-year.

23rd October 2018

- 0 commentsADM Capital Europe LLP announces that its Cibus Fund, the global agribusiness investment fund, has been designated as a Guernsey Green Fund, making it the first regulated fund to achieve this status.

The Guernsey Financial Services Commission launched the Guernsey Green Fund in July 2018 and it is only awarded to those funds which meet strict eligibility criteria designed to reassure investors that funds are invested in line with appropriate environmental standards.

19th October 2018

- 0 commentsEdison Strategic Insight: Market valuations improving in UK and Europe. There are risks, but valuation risk is slowly receding, with the exception of the US.

19th October 2018

- 0 commentsA 2018 OECD report has shown that alternative investment companies are thriving, as increasing numbers of small and medium-sized businesses turn to alternative finance as opposed to traditional bank-loans to cover their costs. The report al

16th October 2018

- 0 commentsNew research now offers a unique road map for all emerging and start-up hedge fund managers as they make their way to $1bn AUM. This has been achieved byanalysing the path to growth and crucial insights of larger, more established managers who blazed a trail in building billion-dollar hedge fund businesses.

Produced by the Alternative Investment Management Association (AIMA), alternative prime broker GPP and Edgefolio, ‘Making it Big’ is informed through an industry wide survey and a series of roundtable discussions posed to asset managers and industry allocators representing an estimated $500bn in total hedge fund AUM. Hedge fund representation in the report includes responses from 155 managers and, crucially, also reflects the opinions of 60 hedge fund allocators, accounting for approximately $89bn.

12th October 2018

- 0 commentsMaven Property, the property arm of Maven Capital Partners, has completed the £14.5 million sale of Hotel Indigo Glasgow, a four-star, 94-bedroom hotel with restaurant in the centre of the city, to Heeton Holdings, a Singapore-listed real estate conglomerate.

The structure of the transaction includes the sale of the Freehold (in Scotland “Heritable”) interest in the hotel to a Ground Rent Fund and of the resultant long leasehold interest to Heeton, which has acquired the trading business and goodwill of the Hotel. There has been little precedent in structuring hotel sales in this way, but Maven’s significant experience of hotel development funding structures has enabled it to split these two interests in the Hotel and drive additional value for its investors.

8th October 2018

- 0 commentsBritish Business Investments, a commercial subsidiary of the British Business Bank, has made a £25m Tier 2 capital investment in Secure Trust Bank, demonstrating its continued commitment to improving access to capital for UK smaller businesses.Secure Trust Bank focuses on carefully selected segments of the business and consumer markets and this year signed up its one millionth customer.

4th October 2018

- 0 commentsEos Venture Partners, the specialist venture capital fund investing in insurance technology (InsurTech), has made its first two investments. The fund is one of the first global, strategic InsurTech investment funds targeting early and growth stage investments.

The first two investments are in Concirrus, a marine insurance analytics platform and in Digital Fineprint (DFP) an SME-focused lead generation and underwriting solution.

24th September 2018

- 0 commentsThe UK Treasury Select Committee’s conclusion that crypto-assets should be regulated demonstrates cryptocurrencies are part of mainstream finance and the sector is likely to rally as a result.

This is an observation from Nigel Green, founder and CEO of deVere Group, which launched the exchange app deVere Crypto earlier this year following a unanimously-agreed report by the Commons Select Committee on crypto-assets for its Digital Currencies

24th September 2018

- 0 commentsFUNDING Circle is seeking a market valuation of up to £1.8bn through its upcoming initial public offering (IPO) on the London Stock Exchange.

20th September 2018

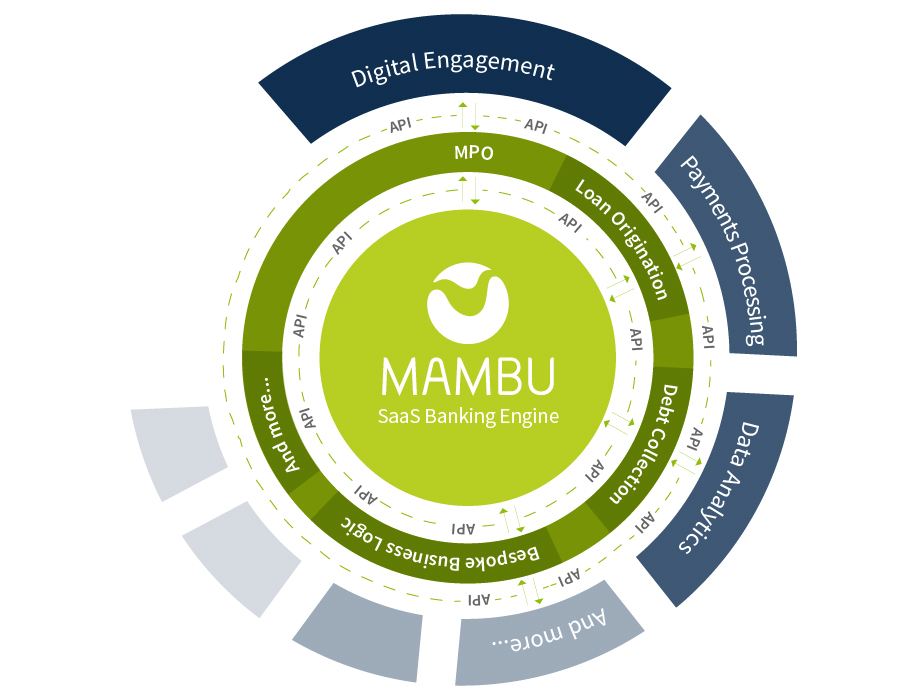

- 0 commentsMambu, the SaaS banking engine powering modern digital financial services, has launched Mambu Process Orchestrator (MPO).

Back to Homepage