29th October 2021

- 0 commentsTAINA Technology, an award-winning regulatory technology company, has announced that it is closing a substantial funding round, welcoming onboard Deutsche Bank and HSBC Asset Management’s Financial Technology Venture Capital Fund alongside its existing investors led by Anthemis.

28th October 2021

- 0 commentsAdmix, the leading In-Play monetization company that bridges the gap between gaming content and brands, has raised USD $25 million in a Series B round to scale up its In-Play solution worldwide; and establish it as the content monetization layer for the metaverse.

28th October 2021

- 0 commentsPALATINE the leading mid-market private equity investor has made a successful partial exit from CET Group with the sale of its tech-enabled insurance claims management division to HomeServe plc for £53m. Based in Castle Donington, CET is a leading provider of outsourced home emergency, drainage and subsidence services to one in eight UK households.

26th October 2021

- 0 commentsMarket-leading private market digital platform VALK is building for expansion after achieving $4 billion-plus in assets and deals managed on its platform in a year

21st October 2021

- 0 commentsPrimer has closed a Series B funding round that values the payments infrastructure startup at $425 million only 20 months after being founded.

The $50M Series B fundraise was led by ICONIQ Growth, the San Francisco based investment firm that has backed global tech companies such as Adyen and Marqeta to Snowflake and Datadog. Existing investors, including Accel, Balderton Capital, Seedcamp, Speedinvest, and RTP Global all participated in the round.

18th October 2021

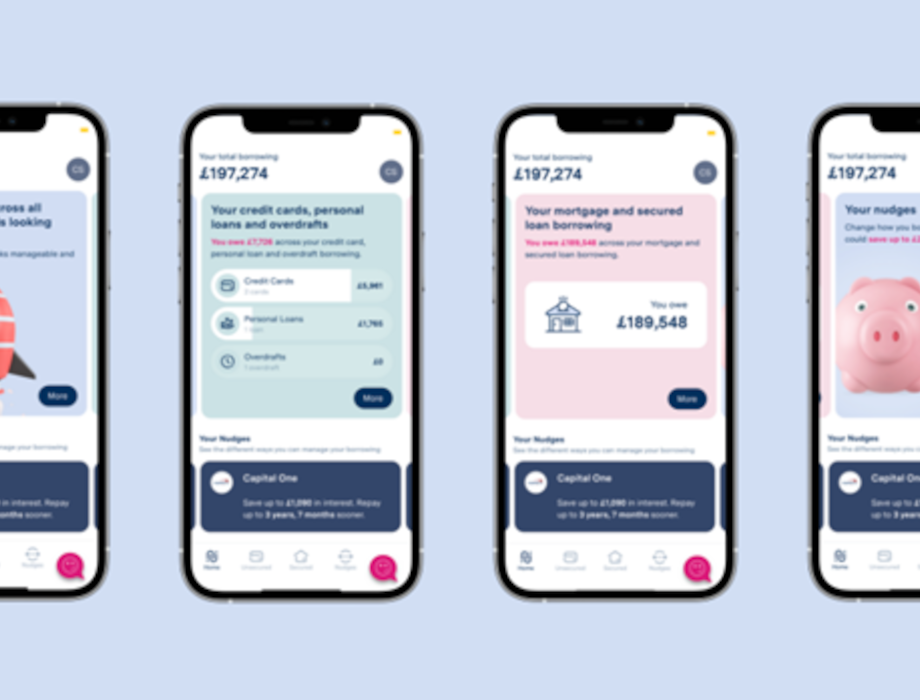

- 0 commentsBorrower wellbeing app, ilumoni has officially launched and is now available to download on Android and iOS devices. The app, which has received £1.63 million in investment since inception and gained FCA authorisation earlier this year, has successfully completed its Beta testing and is now available to the wider market.

14th October 2021

- 0 comments9fin, a leading provider of data, news and predictive analytics for debt capital markets, has announced an £8m Series A round to fuel its expansion into the US. The company is opening a New York office following increased demand from existing customers in Europe. The latest investment was led by Redalpine, alongside previous investors in the company, Fly Ventures. Angel investors Paul Forster, Co-Founder of Indeed, and Alan Morgan, Co-Founder of MMC Ventures, also participated, along with Ilavska Vuillermoz Capital and a number of high net worth individuals

12th October 2021

- 0 commentsGetsafe, the digital insurer targeting millennial buyers in Germany and the UK, has expanded its Series B funding round to $93M. The company is now serving a quarter of a million customers in Germany and the UK, consolidating its position as Europe's largest neo-insurer.

11th October 2021

- 0 commentsForesight Group, an award-winning listed alternative investment manager, has provided a senior secured debt facility of up to £15 million to Channel Islands multi-product specialist lender Reto Finance.

4th October 2021

- 0 commentsTransferGo, one of the world’s fastest growing money transfer companies, has secured $50m in a Series C funding round. This latest fundraise, led by Elbrus Capital Fund III and Black River Ventures, follows consistent 80% year-on-year growth for the fintech company since its launch, and brings the total raised to-date for TransferGo to $77m.

28th September 2021

- 0 commentsBook Salon, a Finnish payment and booking service provider specializing in hair, beauty, and wellness companies, has announced the successful closure of a €1M funding round led by Big Bets VC. Sontek Ventures and well-known business angel Lennu Keinänen also participated in the round. The funding will be used to further expand its operations, and prepare for further growth in Europe as the company looks to expand its offering.

23rd September 2021

- 0 commentsLondon-based Wiserfunding, a leading provider of credit risk assessment for SME lenders, has announced it has secured £3 million investment from BGF – the UK and Ireland’s most active growth capital investor. This investment will support Wiserfunding in accelerating international expansion and strengthening its global position.

Back to Homepage