28th May 2021

- 0 commentsBGF, the UK and Ireland’s most active growth capital investor, has reported record-breaking results and surging growth in its 2020 Annual Report and Accounts.

26th May 2021

- 0 commentsNearly three-quarters (74%) of entrepreneurs and investors say they have witnessed discrimination within the startup community, harming the growth of many early-stage businesses.

24th May 2021

- 0 commentsCompanies in the digital, media and internet sectors have taken advantage of the open public markets, with no fewer than 18 IPOs completed in the first quarter of 2021.

19th May 2021

- 0 commentsA report issued this week paints a bright future for Midlands-based businesses and showcases the opportunity for investment in what appears to be an undercapitalised region in the UK.

The report, commissioned by the Midlands Innovation Commercialisation of Research Accelerator (MICRA), and produced by Beauhurst, a platform that provides data on the UK's high-growth and innovative companies, is based on data from 3,453 high-growth Midlands-based companies.

19th May 2021

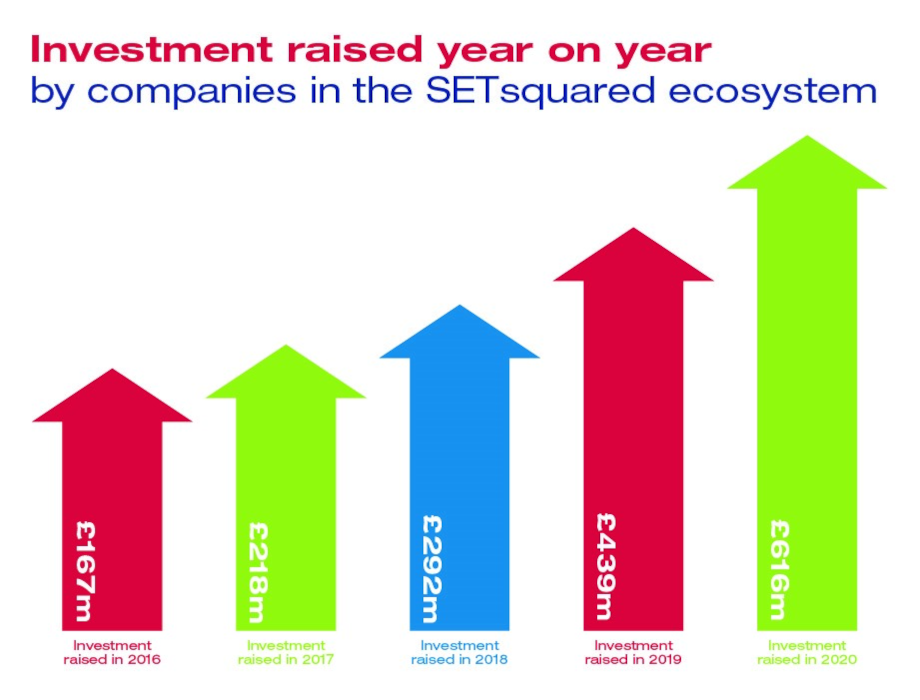

- 0 commentsSETsquared has released data which shows that a record level of investment was raised by its member companies in 2020, despite the pandemic. Investment from private and public sources across the year, totalled £616m, which represents a 40% increase on 2019.

18th May 2021

- 0 commentsThe vast majority (81%) of businesses that carry out research and innovation work in the UK reproted delays or stoppages

11th May 2021

- 0 comments670 initial public offerings have been recorded globally so far during 2021, more than double the number recorded during the same period in 2020 and the highest year-to-date tally in more than two decades according to Refinitiv Deals Intelligence.

7th May 2021

- 0 commentsUS$1.77 trillion worth of M&A deals were announced globally during the first four months of 2021, more than double (+124%) the same period last year and the highest year-to-date total since their records began according to the latest snapshot from Refinitiv Deals Intelligence.

5th May 2021

- 0 commentsA new report from eFront, the leading financial software and solutions provider dedicated to Alternative Investments, shows that holding periods extended in 2020 to a record 5.4 years on average, at the same time as returns dipped. The data also showed that investments held for longer periods tend to produce higher returns – though this was not the case in 2020.

30th April 2021

- 0 commentsGP Bullhound has published its latest quarterly market reports. Read all about the CEOs and the key trends they see in the Software, Digital Services, Fintech, Digital Media and Marketplaces sectors, as well as an update on Asian tech investments.

29th April 2021

- 0 commentsResearch from Yoppie

27th April 2021

- 0 commentsCornerstone Partners, a leading angel network focused on investing in exceptional black and diverse founder led businesses across the UK, has released a ground-breaking report in collaboration with Engage Inclusivity, Diversity VC and Beauhurst about the barriers to inclusive investment for minority founders in the UK.

The purpose of the research is to identify how many black and minority ethnic founders have achieved VC backing, in addition to unveiling insights into diverse founders’ journeys and experiences of securing funding. The Cornerstone Report takes a closer look at the funding landscape for minority ethnic founders at two specific and critical stages of their funding journey: the seed/pre-VC stage (Cohort 1) and scale up/VC funded stage (Cohort 2).

Back to Homepage