13th June 2025

- 0 commentsMarissa Krummrich, Investment Manager at b2ventures, explains the thinking behind leading Kiin Bio's $2.2m pre-seed round, with co-investment from Heartfelt, rule30 and angel investors.

13th June 2025

- 0 commentsA pioneering Scottish technology that could dramatically speed up the development of life-saving cancer treatments has secured a £750,000 seed investment. ScreenIn3D, a spin-out of the University of Strathclyde, has developed a groundbreaking "lab-on-a-chip" system that allows drug developers to test dozens of cancer therapies on tiny patient-derived tumour samples - offering a faster, easier and more accurate alternative to animal testing.

6th June 2025

- 0 commentsForesight Group has invested £3 million in Ad Signal, a provider of content intelligence for the media and entertainment industry.

Foresight's investment will allow the Company to accelerate the rollout of new products and expand its commercial footprint, capitalising on growing demand from broadcasters, platforms and post-production houses seeking more efficient, cost-effective content management solutions.

6th June 2025

- 0 commentsOxford Capital has backed NavLive, a University of Oxford spin-out that uses artificial intelligence and LiDAR to turn any building into an accurate digital twin in minutes. The £4m round has Oxford Capital investing alongside SOSV and existing shareholders Oxford Science Enterprises, Clearance Capital, Britbots and AE Works.

6th June 2025

- 0 commentsValla, the trailblazing legal platform placing employment rights back into workers' hands, has secured £2 million in seed funding to democratise access to justice for millions across the UK. The funding was backed by top global VCs and angel investors including Tom Blomfield, Ada Ventures, Active Partners, and Portfolio Ventures.

6th June 2025

- 0 commentsAnkar, a platform leveraging AI agents to transform how innovators and companies across the world capture, protect and monetise their intellectual property (IP), has raised a £3m Seed round led by Index Ventures. They were joined by Daphni, Motier Ventures, Booom and Puzzle Ventures, as well as leading angels including Datadog CEO, Olivier Pomel and Hugging Face CTO, Julien Chaumond. Founded in 2024, the tech is already being embraced by Fortune500 companies.

6th June 2025

- 0 commentsMotion, a London-based care technology startup, has closed a funding round of over £250,000 to accelerate the digital transformation of UK care homes.

6th June 2025

- 0 commentsLifted Ventures, the female-founded investment network championing women entrepreneurs, has formed a strategic partnership with prominent law firm Gordons and leading wealth manager RBC Brewin Dolphin. This partnership is designed to catalyse investment into women-led businesses and to grow the number of women investors in the UK's early-stage funding ecosystem.

In addition to supporting women founders, the partnership places a strong emphasis on encouraging and equipping more women to become active angel investors, helping to reshape the investment landscape from both sides of the table.

6th June 2025

- 0 commentsFinland: Medtech startup AIATELLA has secured €2 million in funding to accelerate the development and scaling of its AI-powered cardiovascular imaging technology. The funding will help the company conduct clinical trials and develop its ultrasound-based preventative screening, which detects and quantifies carotid artery narrowing in minutes. The round was led by Helsinki-based Nordic Science Investments, with Specialist VC, Harjavalta Ventures, Business Finland, and a syndicate of angel investors also joining the round.

6th June 2025

- 0 commentsNorthern Gritstone has led a £4.6 million seed investment into Newcastle University spinout Literal Labs, an AI algorithm company that uses logic-based techniques to generate custom AI models. Led by ex-Arm executive Noel Hurley, this is Northern Gritstone's first investment linked to Newcastle University.

6th June 2025

- 0 commentsConstruction tech company Automated Architecture (AUAR) has closed £5.1m in funding to make sustainable, affordable housing universally accessible. Its groundbreaking automation and robotics platform and decentralised approach helps homebuilders cut construction costs by 30–40% and removes critical bottlenecks in their value chain.

30th May 2025

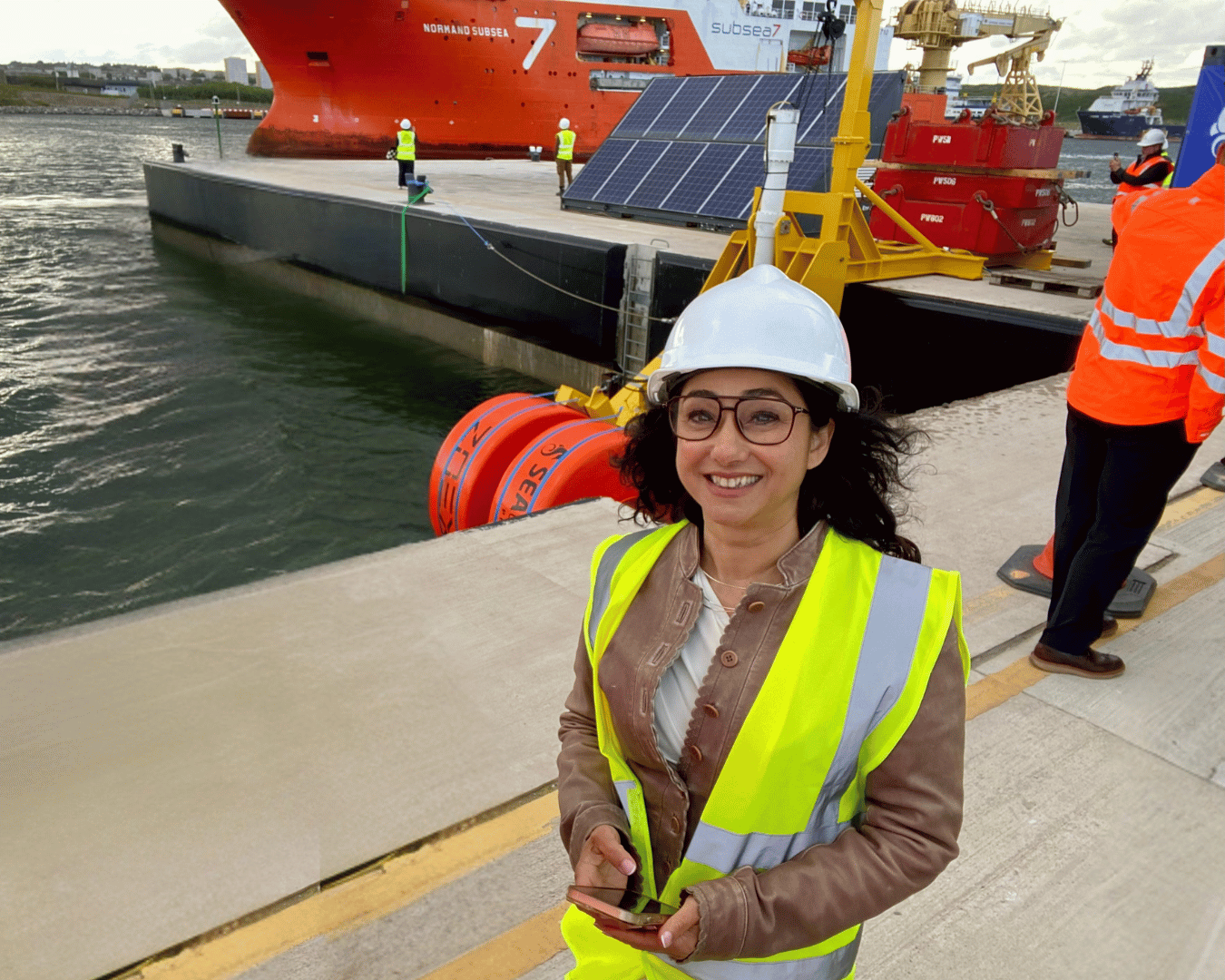

- 0 commentsAberdeen-based ZOEX Ltd, the UK’s only female-founded wave energy company, is riding a wave of investment success after securing £531,000 funding including investment from Equity Gap, one of Scotland’s leading angel investment syndicates, The University of Strathclyde and Scottish Enterprise.

Back to Homepage