2nd May 2025

- 0 commentsThe British Business Bank has committed £7 million to a new platform enabling it to invest alongside five of the UK's promising and emerging angel syndicates. The platform will be managed by Haatch, an existing partner of the Bank.

17th April 2025

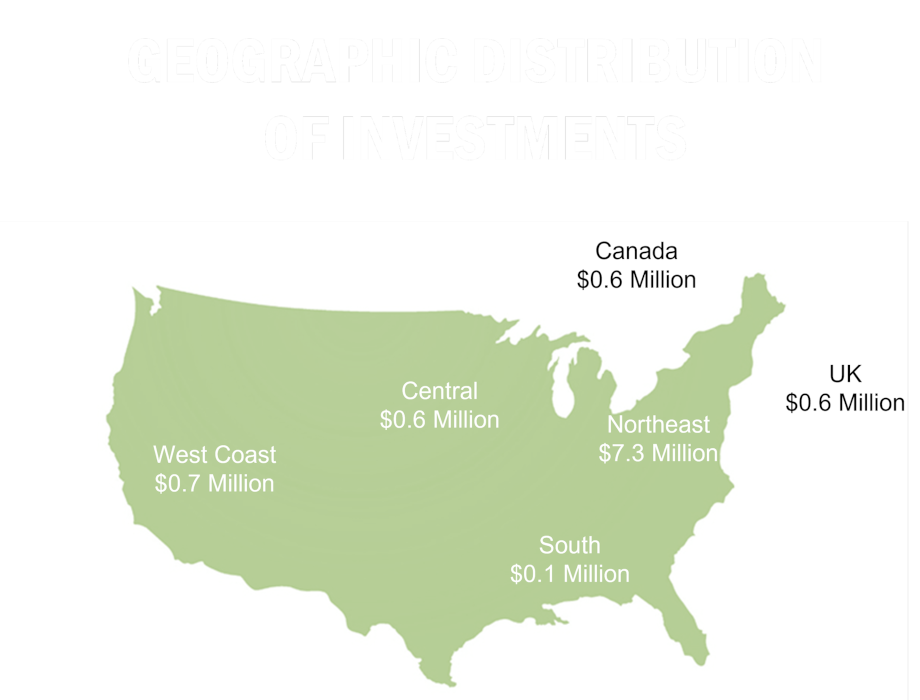

- 0 commentsNEW YORK: The final numbers are in, and 2024 was a very successful year for New York Angels (NYA).

4th April 2025

- 0 commentsIreland's population of angel investors is on the rise with 290 new members joining the Halo Business Angel Network.

More than €25m was invested in Irish start-ups by angel investors between April 2023 and December 2024, according to new data from Halo Business Angel Network (HBAN).

14th March 2025

- 0 commentsA pioneering angel investment initiative, fhunded angels, has been officially launched by Lancashire County Council (LCC). Part of LCC's highly successful fhunded early-stage finance programme, fhunded angels is thought to be the UK's first angel network to be led and managed by a local authority at such a scale.

7th March 2025

- 0 commentsAraya Ventures has completed a second close of the Araya Super Angel Fund at £18.2million and received a milestone £5 million commitment from British Business Investments, a subsidiary of the British Business Bank, co-investing alongside the Araya Super Angel Fund.

The community-powered fund which will invest in up to 60 innovative pre-seed and seed stage primarily UK startups across the next four years that are transforming the way we live and work across Health, FinTech, Commerce and Future of Work.

7th March 2025

- 0 commentsHands In, a fintech innovator in split payment solutions, has successfully raised over £1 million in its latest funding round. This investment will accelerate Hands In's expansion across key sectors, enhance its technology, and scale operations to support a growing enterprise customer base.

The round includes backing from CONCRYT, a pioneering fintech initiative led by industry experts, reaffirming strong confidence in Hands In's vision.

The round includes backing from prominent fintech angel investors, including Ryta Zasiekina, a distinguished angel investor and founder of CONCRYT. Ryta brings over a decade of leadership experience in payments and banking, having been featured in The Times and Forbes as a thought leader in fintech and emerging technologies.

28th February 2025

- 0 commentsFundMyPitch, the investment platform connecting angel and institutional investors with early-stage businesses, has secured a significant pre-seed funding round led by the Lazaroo-Hood Group, with follow-on investment from Bigspace Investments and prominent angel investors. The company has also received backing from InvestNI through its Ambition to Grow Grant, further accelerating its expansion.

This investment will fuel FundMyPitch’s growth across the UK, allowing the platform to expand investor access, enhance platform capabilities, and move towards regulatory authorisation to facilitate direct investment transactions.

14th February 2025

- 0 commentsDorset Business Angels (DBA) kicked off 2025 with its first pitch event of the year on February 3rd at the Carlton Hotel in Bournemouth, introducing an innovative new ‘Meet the Founder' session.

14th February 2025

- 0 commentsSFC Capital, the UK’s most active seed-stage investor, has received an additional £10 million commitment from British Business Investments, a commercial subsidiary of the British Business Bank, through its Regional Angels Programme, which is designed to reduce regional imbalances in access to early-stage equity finance across the UK.

31st January 2025

- 0 commentsThe North of England has some of the most exciting innovations in healthcare, but finding funding to develop and commercialise many of these ground-breaking ideas can often be very difficult.

31st January 2025

- 0 commentsSFC Capital, the UK's most active early-stage investor, has made its 500th portfolio company investment, marking a significant milestone in its mission to support ambitious entrepreneurs and drive innovation across the UK.

Founded in 2012 as the "Startup Funding Club" angel network, SFC Capital was an early adopter of the Seed Enterprise Investment Scheme (SEIS), establishing one of the first SEIS funds. This pioneering approach laid the groundwork for over a decade of success in early-stage investment.

17th January 2025

- 0 commentsDorset Business Angels first pitch event and investors' dinner of 2025 will be held on February 3rd at the Bournemouth Carlton Hotel.

Five local entrepreneurs have been invited to pitch for investment at the event from across a range of industry sectors.

Back to Homepage