7th October 2022

- 1 commentsRound 4 of the Green Angel Syndicate EIS & SEIS Climate Change Fund opened on Friday 1st July and closed on 22nd September, having exceeded its minimum funding target by 50%. The round was evenly split between GAS members and non-members, and 45% of investors had invested in one or more previous rounds of the Climate Change Fund.

7th October 2022

- 1 commentsArchangels, the world’s longest continually running investment syndicate, has generated up to £1.4 billion Gross Value Added (GVA) for the Scottish economy from its investments in the life sciences and tech sectors.

7th October 2022

- 0 commentsCatalyst is inviting budding entrepreneurs across Northern Ireland to apply to their Co-Founders programme, launching with a newfound focus on the United Nations’ Sustainable Development Goals.

7th October 2022

- 0 commentsLawhive, the AI and data-driven Legaltech platform, has successfully raised $2M in seed funding to increase transparency and democratise access to legal services for consumers and small businesses in the UK. The round was led by Episode 1 Ventures and includes additional support from Tiny VC and 25 angel investors, including Aron Gelbard (Bloom & Wild Founder), Jonathan Petrides (Allplants Founder) and senior executives from Monzo, Spotify, Meta and N26.

7th October 2022

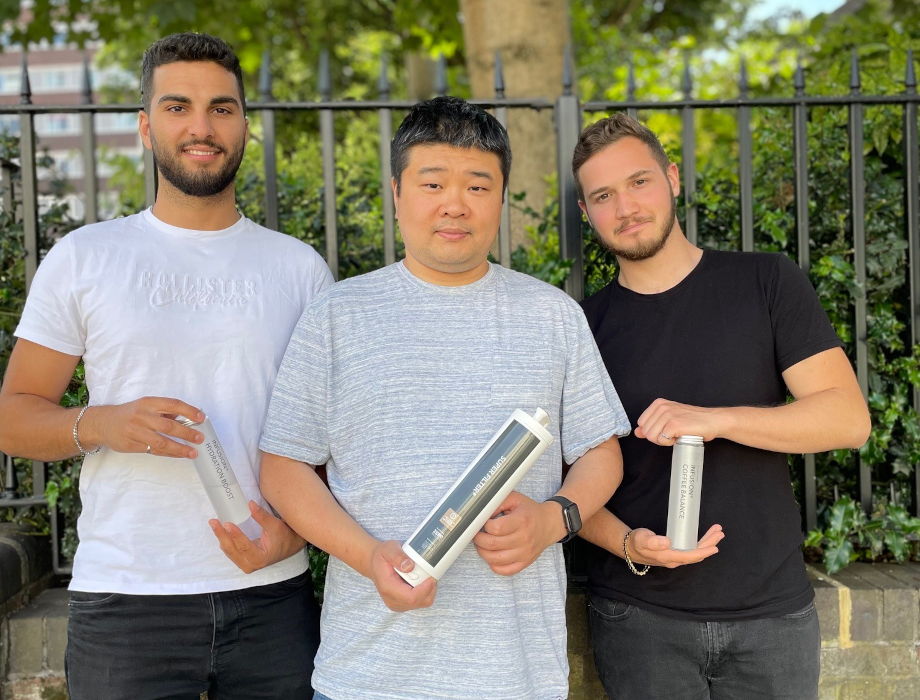

- 0 commentsSküma Water has raised £300,000 in a pre-seed funding round led by early-stage focused venture capital firm Jenson Funding Partners. Multiple angel investors also participated in the round, including William Ripley, a notable investor in sustainable technology and ex-director of product strategy at Philips.

7th October 2022

- 0 commentsAcurable, an award-winning wearable medical devices company, has announced an €11m investment as a result of its Series A funding round. The funds will be used to accelerate the international expansion of its first product AcuPebble SA100 and drive the company towards its ambition to become the preferred solution for home sleep testing worldwide. The investment was led by Kibo Ventures, along with Mundi Ventures, Kindred Capital, angel investors and Comprador Holdings among others.

7th October 2022

- 0 commentsOpen banking-powered fintech Currensea has secured £2.4m from leading Venture Capitalists Blackfinch Ventures and 1818 Venture Capital, along with existing and new angel investors, which will be used to accelerate the fintech’s ambitious growth plans.

7th October 2022

- 0 commentsBuilding on its recent launch and in line with its growth plans for North America and Europe, KYP has announced the closure of its pre-seed funding round with total funds of approximately £800,000 raised. Despite often quoted challenging market conditions, KYP pre-seed round was 35% oversubscribed with the support of US based 1414 Ventures, BH Ventures and some leading UK Angel Investors.

7th October 2022

- 0 comments

Edinburgh startup, Gecko Glazing, has created an affordable, easily-installed alternative to double glazing that can cut window heat loss and carbon emissions by up to 50%. With huge potential to improve inefficient homes, including historic and listed buildings, the company has just secured a £150k investment in a funding round led by British Design Fund.

7th October 2022

- 0 commentsBVA BDRC's latest quarterly SME Finance Monitor findings shows that rising costs, the economic environment and climate change are contributing a stall in SME recovery.

4th October 2022

- 0 commentsSidekick, a digital active investment manager built for today’s rapidly changing world, has announced a £3.33M Pre-Seed equity round led by Octopus Ventures, one of Europe’s largest and most active venture capital investors. Seedcamp, Europe’s leading early-stage fund, and Semantic, a venture fund investing in new rails for data and the digital economy, also participated in the round.

30th September 2022

- 0 commentsInnovate UK KTN has chosen 13 startups of the future to take part in its prestigious sustainability accelerator programme. Over the next ten weeks, 13 companies selected from the Sustainable Innovation Fund will work with Innovate UK KTN and their partners Growth Studio to further develop their propositions and prepare to raise external capital.

Back to Homepage