19th November 2021

- 0 comments

Eskuta Limited has received a total of £1m worth of funding from The Midlands Engine Investment Fund (MEIF), West Mids Debt Finance Fund, managed by Maven Capital Partners, and backed by the Recovery Loan Scheme (RLS). The business, which has headquarters in Nuneaton, had already received funding from MEIF to support the business’s ambitious growth plans, but has now received a second funding round of £500,000, bringing the total to £1m.

11th November 2021

- 0 commentsA Wellingborough-based paper honeycomb board manufacturer has secured £750,000 to expand its product range, create jobs and enter new markets. The Alternative Pallet Company Ltd who trade as PALLITE® received funding from the Midlands Engine Investment Fund (MEIF) provided by The FSE Group Debt Finance Fund and backed by the Coronavirus Business Interruption Loan Scheme (CBILS). The MEIF funding will help to create 15 new jobs in the next year, with the ability to offer apprenticeships to the under-25s.

5th November 2021

- 0 commentsArcmont Asset Management, a leading European private debt asset management firm, has announced the successful completion of the fundraising of its Senior Loan Fund II and associated vehicles, attracting total investable capital of €5 billion.

3rd November 2021

- 0 commentsCoalville-based children’s clothing business, Tiny Explorer Apparel, trading as the Töastie Kids brand, has secured a £300,000 investment to develop a new product range and support a comprehensive marketing campaign.

26th October 2021

- 0 commentsManaged by Maven Capital Partners and part of the Northern Powerhouse Investment Fund, NPIF - Maven Equity Finance, has exited Intec Business Solutions; a group offering end-to-end technology consultancy and specialist support services for SMEs.

26th October 2021

- 0 commentsThe British Business Bank has announced that the Recovery Loan Scheme has passed a significant milestone, with 76 accredited lenders having offered over £1bn to smaller UK businesses as they steer a path towards a sustainable recovery.

21st October 2021

- 0 commentsBirmingham-based Hollywood Monster has secured a £250,000 loan enabling it to safeguard 40 employees whilst creating seven new positions over a three year period. The business received the funding from the Midlands Engine Investment Fund (MEIF), provided by The FSE Group, Debt Finance Fund and backed by the Coronavirus Business Interruption Loan Scheme (CBILS).

20th October 2021

- 0 commentsSoMo, one of the UK’s leading specialist lenders, has set itself a target of lending £250m over the next 12 months and has set the wheels in motion with newly announced premises in London, which will act as a central hub for future expansion and to further cement their presence across the UK.

12th October 2021

- 0 commentsRapidly growing biomass fuel manufacturer Land Energy (LE) has secured £6 million in funding from Independent Growth Finance (IGF). The asset business lending (ABL) package includes invoice finance, inventory and equipment facilities. The significant working capital will enable the company to expand its operations and develop a new, clean-burning briquette aimed at the domestic solid fuel market.

11th October 2021

- 0 commentsForesight Group, an award-winning listed alternative investment manager, has provided a senior secured debt facility of up to £15 million to Channel Islands multi-product specialist lender Reto Finance.

11th October 2021

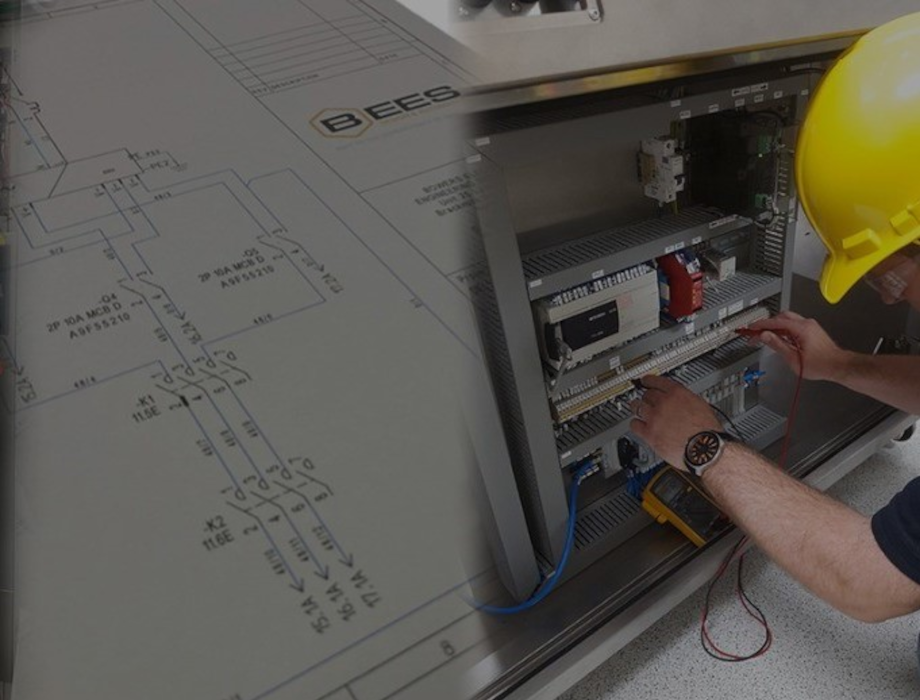

- 0 commentsBowers Electrical Engineering Services Ltd has secured £250,000 from Maven Capital Partners E&SE Midlands Debt Finance fund, through the Midlands Engine Investment Fund (MEIF) and backed by the Coronavirus Business Interruption Scheme Loan (CBILS).

5th October 2021

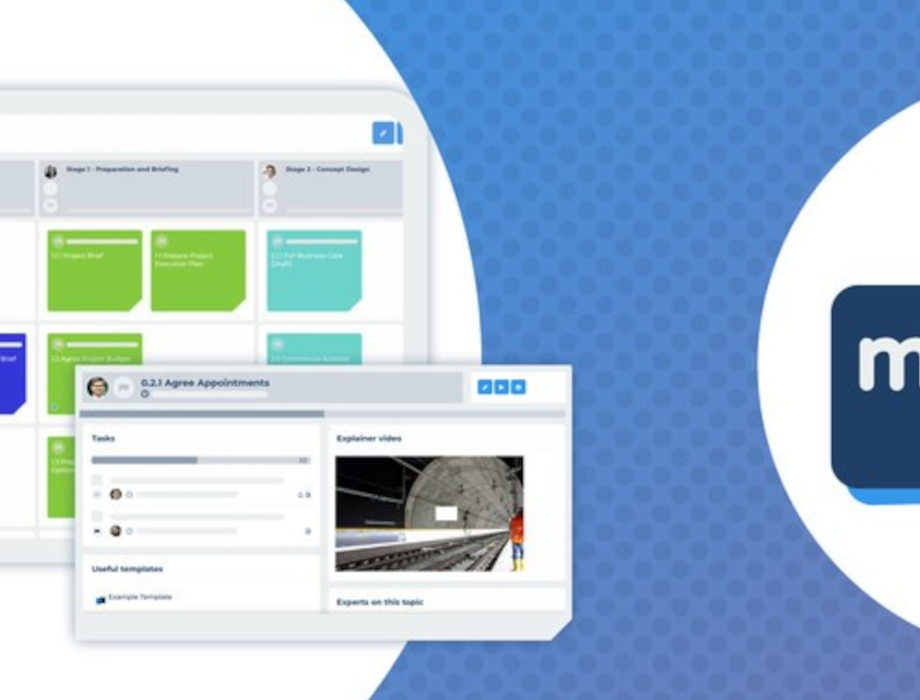

- 0 commentsMethod Grid, providers of an enterprise-level connected assurance platform for regulated sectors, including engineering-construction and consultancy, with plans to expand into new project-based sectors, have raised their third round of investment from a network of eleven private investors. Including new funding and conversion of loan into equity, Method Grid have received a total of roughly £1 million to fuel their expansion into new markets and development of their integrated platform capabilities.

Back to Homepage