6th January 2023

- 0 commentsTwo leading doctors who developed a new health coaching platform after the untimely death of a colleague have raised over £1m in a funding round led by private equity firm Traditum and backed by angel investors. The funding will enable physiologist and serial entrepreneur Dr Michael Stein and Oxford University’s Professor Chris Butler to develop their Added Health platform further and roll it out to a wider audience.

6th January 2023

- 0 commentsEdinburgh-based investment syndicate, Archangels, invested £13.4m during 2022 in some of Scotland’s most promising early-stage tech and life science companies. The total investment for 2022 among 11 businesses marks a 14% increase on Archangels’ investment activity in 2021 (11.8m). New additions to the portfolio included tech firm Earth Blox who secured £1.5m funding from Archangels to expand its global reach and further develop its no-code Earth Observation (EO) cloud-based SaaS.

6th January 2023

- 0 comments

James Murdoch considers a reduction in sales from his portfolio during the financial crisis.

16th December 2022

- 0 commentsFinance and technology heavyweight, Dominique Cerutti, has given his backing to London based early stage fintech, 1fs Wealth, and its innovative platform that can support wealth owners to consolidate and manage their assets.

16th December 2022

- 0 commentsCheMastery has raised a seed round led by Science Angel Syndicate, the deep science investor group, and Undeterred Capital. The round was supported by Elbow Beach Capital, Britbots, HERmesa, Fink Family Office, Kadmos Capital, Formic Ventures, Cur8, Key Ventures, Dhyan and angel investors.

16th December 2022

- 0 commentsJellagen, an innovative biotech company and leader in biomaterials derived from jellyfish, has closed a successful £8.7m Series A equity investment round.

16th December 2022

- 0 commentsElizabeth Humphrey, Financial Crime Researcher at Themis discusses the issues around mangaing financial risk due diligence and why it is such an imporant element of comprehensive due diligence for investors and founders alike.

16th December 2022

- 0 commentsUSA: The Launch Place has announced its $250,000 investment in Revibe Technologies, a North Carolina-based startup developing digital therapy software for wearables to treat attention-deficit/hyperactivity disorder (ADHD) and autism. After bringing its flagship artificial intelligence-driven smartwatch and wristband to the adolescent market, the company is iterating on its success with FokusRx—a nonpharmacologic software-as-a-medical device (SaMD) approach to treating attention and focus deficits.

16th December 2022

- 0 commentsAn innovative British start-up, Collective Equity, has launched the UK’s first equity pooling fund to give liquidity to founders who have their entire wealth tied up in the businesses they create. Founders and shareholders can invest up to 10% of their equity, instead of cash, into the fund and share in the success of other high-growth, vetted companies. When one or more of the Limited Partners in the fund has a liquidity event, such as an IPO or acquisition, everyone in the fund receives a share of the proceeds. This gives founders multiple opportunities to convert their equity into cash.

16th December 2022

- 0 commentsForesight Group has provided a £400,000 growth capital investment into Texture Jet Limited from the Midlands Engine Investment Fund as part of a wider £650,000 funding round, also involving the University of Nottingham and members of the Minerva Angel Investor Group.

16th December 2022

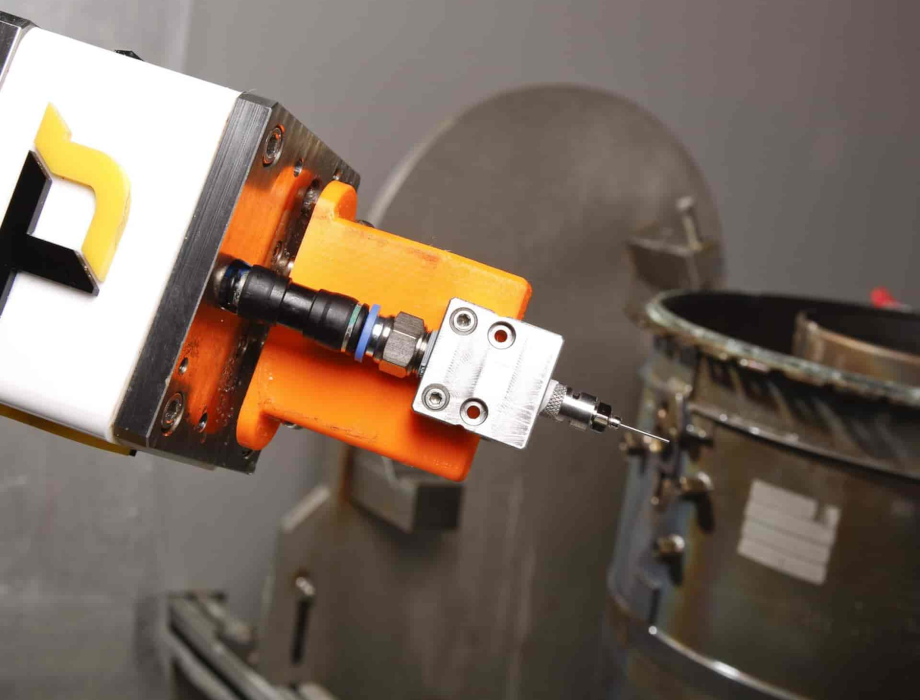

- 0 comments*EU* fruitcore robotics, pioneer of intelligent robotics and automation solutions and creator of HORST digital robots, has raised €23 million to enable companies of all sizes – from medium-sized businesses to global corporations – to introduce robotics- and automation solutions into their manufacturing. Three years after its market launch, fruitcore robotics is already automating several hundred different applications in 29 different industries in Germany, Austria, Switzerland and Italy. The 60+ partner network in the DACH region and Italy is being continuously expanded.

16th December 2022

- 0 commentsIrish cybersecurity start-up Vaultree has closed a $12.8m Series A funding round led by Molten Ventures.

Founded in 2020 and based in Cork, Vaultree is working towards real-time searchable and fully homomorphic encryption technology.

The aim is to help highly regulated organisations access and use their data without having to reveal encryption keys or the data content to a tech or cloud provider.

Back to Homepage