17th January 2019

- 0 commentsA fast-growing online retailer, TheVeganKind.com, has moved into a bigger warehouse in Glasgow after receiving financial backing from more than 700 vegans across Britain.

17th January 2019

- 0 commentsCycle.land, the bike sharing marketplace unlocking the assets of unused bikes, has announced that it has raised over £200,000, thanks to its highly successful second equity crowdfunding campaign on Seedrs.

11th January 2019

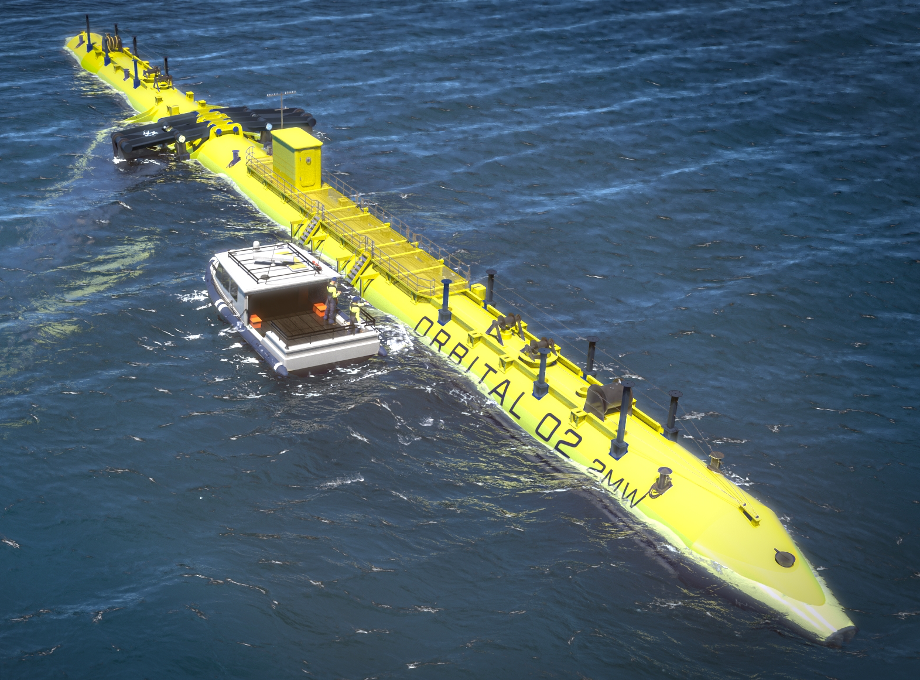

- 0 commentsThe UK’s leading peer-to-peer ethical investment company Abundance has started the year with the closing its largest fund raise to date, raising £7 million for innovative Scottish tidal energy company Orbital Marine Power (Orkney).

8th January 2019

- 0 commentsCrowdcube hit its best-ever figures across a range of measures in 2018, as crowdfunding continues to cement its popularity with entrepreneurs and investors, despite a backdrop of broader economic uncertainty and concerns around Brexit.

2018 revenue is up 50% to £6m, from £4m in 2017, while investment pledged to growing companies through the platform is up 72% to £224m, from £130m the previous year. The number of successful raises on the platform, at 198, is 35% larger than the previous year’s total of 147.

Q4 2018 was Crowdcube’s most successful quarter ever, with revenue at £1.8m (up 50% from £1.2m in Q4 2017), and investment pledged at £84.6m (up 94% from £43.6m). The number of successful raises rose from 45 to 49, an increase of 9%, while the average amount per successful raise went up from £732,000 to £1,430,000, an increase of 95%.

7th January 2019

- 0 commentsLeading private equity investment platform Seedrs has announced a record-breaking year full of industry firsts, European growth and the highest levels of investment on the platform to date. The Woodford-backed platform saw nearly a 60% increase in investment activity from last year, recording £195 million invested into pitches on the platform in 2018. 2018 saw 186 successful pitches from businesses who raised on Seedrs from 12 different countries, 28 of which were fundraises of over £1 million. Highlights included fast-growing international money transfer platform Transfergo, which raised €11.3 million from 1,047 investors.

7th January 2019

- 0 commentsThe Plant Hub, a brand-new space coming to East London in January 2019 is set to revolutionise the way we see, eat and understand vegetables after the huge success of their Kickstarter which saw 126 backers raising £20,999.

18th December 2018

- 0 commentsInvestment platform Downing Crowd has launched its first bond to offer investors an attractive fixed return of 7.5% p.a. plus the potential for added equity upside.

The Pelham House Bond has a relatively high estimated loan-to-cost (LTC) ratio of 74% and to allow the business to invest in its growth, Downing investors’ interest will be rolled up for the first two years – making it aimed at more sophisticated investors. To reward investors for taking on this higher level of risk, the bond will also give shares to investors in proportion to their debt investment. This equity entitles investors to a share in any potential upside over the term of the investment.

11th December 2018

- 0 commentsSeedrs, Europe’s leading equity investment platform, announces that shareholders of portfolio company Oppo Brothers have received an offer to buyout all of their shares.

Seedrs investors have invested over £1.1 million into Oppo over the course of three rounds. The buyout offer will see investors receive £6.15 per share, which represents a significant profit for all of them:

- Seedrs investors who invested in Oppo in their 2015 round did so at a price of £1.414 per share, meaning that they will earn a 4.35x return on their investment. This goes up to 6.21x, and no CGT to pay, for those who were able to take advantage of EIS tax reliefs.

- Oppo raised a second round through Seedrs in 2016 at £2.85 per share, so this offer represents at 2.16x return (3.08x, and no CGT to pay, after tax reliefs) for them.

- Seedrs investors also invested in an Oppo convertible instrument in 2017, and they will receive a 1.5x return on their investment.

7th December 2018

- 0 commentsCrowdProperty has become the latest peer-to-peer loan originator to disclose their lending performance using Brismo’s methodology. In doing so they have become the first real estate development lender to adhere to an independent performance standard.

5th December 2018

- 0 comments9 companies reached their funding targets with Seedrs in November

3rd December 2018

- 0 comments

Strategic land investment platform Intro Crowd is pleased to welcome a new member to their board of directors this week.

21st November 2018

- 0 commentsGohenry, the company behind the gohenry financial tool which is enabling a generation of kids and teens to take part in the digital economy and learn about money, has successfully raised £6.2m via Crowdcube, the world’s first and largest equity crowdfunding platform. The funds raised will be invested in products and marketing, as well as expanding gohenry’s operations in the US.

Gohenry’s raise on Crowdcube launched in September with a target of £2m, which it has exceeded by 3x. Over 3,000 investors have taken part in the raise, which is gohenry’s third on Crowdcube. Gohenry’s previous raises on Crowdcube were in 2016 and 2017, and the total amount gohenry has raised on the platform now stands at over £10m. This latest raise makes gohenry one of the first companies to take advantage of the newly-raised prospectus threshold – previously regulations permitted companies only to raise up to €5m without issuing a prospectus, but in July this figure rose to €8m.

Back to Homepage